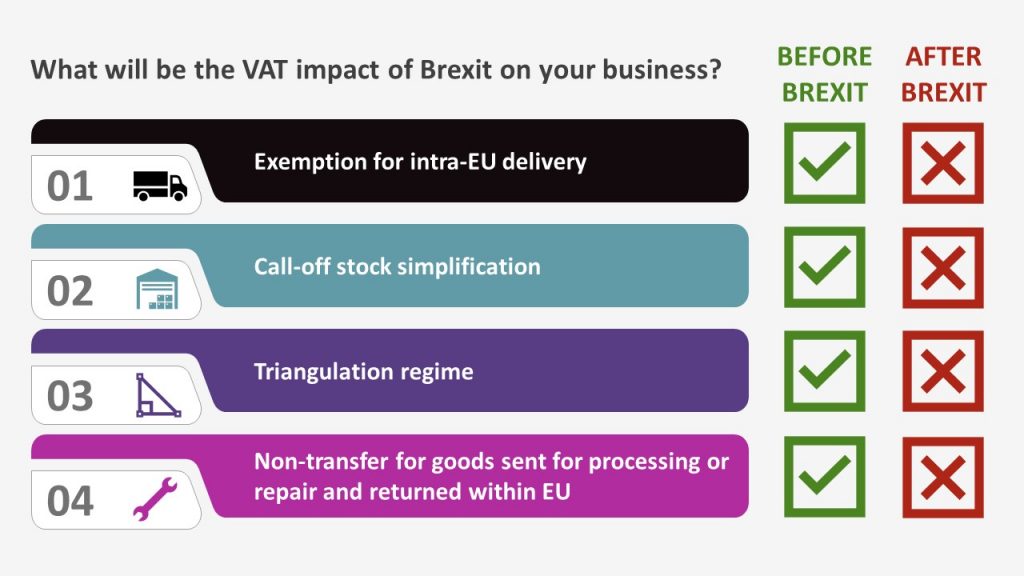

As of the end of the transition period, the EU rules for cross-border supplies and movements between Member States will no longer apply in the relations between Member States and the United Kingdom. VAT regime for intra-EU supplies and acquisitions for goods to and from the United Kingdom will be abroged. Instead, supplies and movements of goods between the EU and the United Kingdom will be subject to the VAT rules on imports and exports. Several simplifying measures for transactions with the United Kingdom will no longer apply, e.g. distance sales, simplified triangular intra-EU transactions, simplifications for consignment stock or intra-EU contract manufacturing, etc.

What Changes?

The main consequence of Brexit on supplies of goods will be the restoration of tax borders between the United Kingdom and the European Union. This will result in the end of the intra-Community rules currently applicable to the movement of goods from the United Kingdom to the EU. The supply of goods by a taxable person in the United Kingdom to a client in EU which is a taxable person (B2B) will no longer be treated as an intra-Community acquisition of goods but as an import with following VAT consequences:

If the supplier in the EU takes the status of importer, he/she will be the person liable to pay EU VAT upon importation.

-

VAT due on importation

VAT will be due at the importation in the EU, at the rate that applies to the supplies of the same goods within the EU. VAT will be payable to the Customs Authorities at the time of importation, unless the Member State of importation allows to enter import VAT in the periodical VAT return of the taxable person. The taxable amount is based on the value for customs purposes, but increased by

(a) taxes, duties, levies and other charges due outside the Member State of importation, and those due by reason of importation, excluding the VAT to be levied, and

(b) incidental expenses, such as commission, packing, transport and insurance costs, incurred up to the first place of destination within the territory of the Member State of importation as well as those resulting from transport to another place of destination within the EU, if that other place is known when the chargeable event occurs.

-

Appointment of a VAT Representative

Direct VAT registration is not possible anymore. Any UK business with a foreign VAT registration in the EU may now face the obligation to appoint a VAT representative in most of the 27 EU states. The tax representative undertakes to complete the formalities required of the person who has appointed him (making the statement of establishment, book-keeping, signing turnover returns and paying the tax). The tax representative is legally responsible for meeting his obligations and legally liable for the tax owed. The tax representative has the same right as all other taxable person.

-

VAT due on sales

The supply of goods that he/she carries out afterwards is considered as having taken place in EU and the local VAT is due on this delivery (with or without the application of the reverse charge mechanism depending on the VAT status of the purchaser).

How to get to the solution ?

The goal for each UK company is to minimize the negative impacts of Brexit.

There are ways to :

- Prevent Vat registrations in most EU countries

- Prevent the appointment of fiscal representatives in most EU countries

- Prevent payment of VAT on importation in most EU countries

- Prevent payment of local VAT on subsequent sales in most EU countries

To reach that objective, each UK company must review its operations under the VAT microscope.

We offer a two steps process:

1. Request our Brexit VAT booklet to review and compare operations and identify VAT impacts

2. Request a free video call with one of our VAT expert to challenge or validate your approach which will be concluded by a VAT summary, i.e. a short description of the best solution adapted to your business.