The Author of the Article

To keep in mind

Error in your VAT return

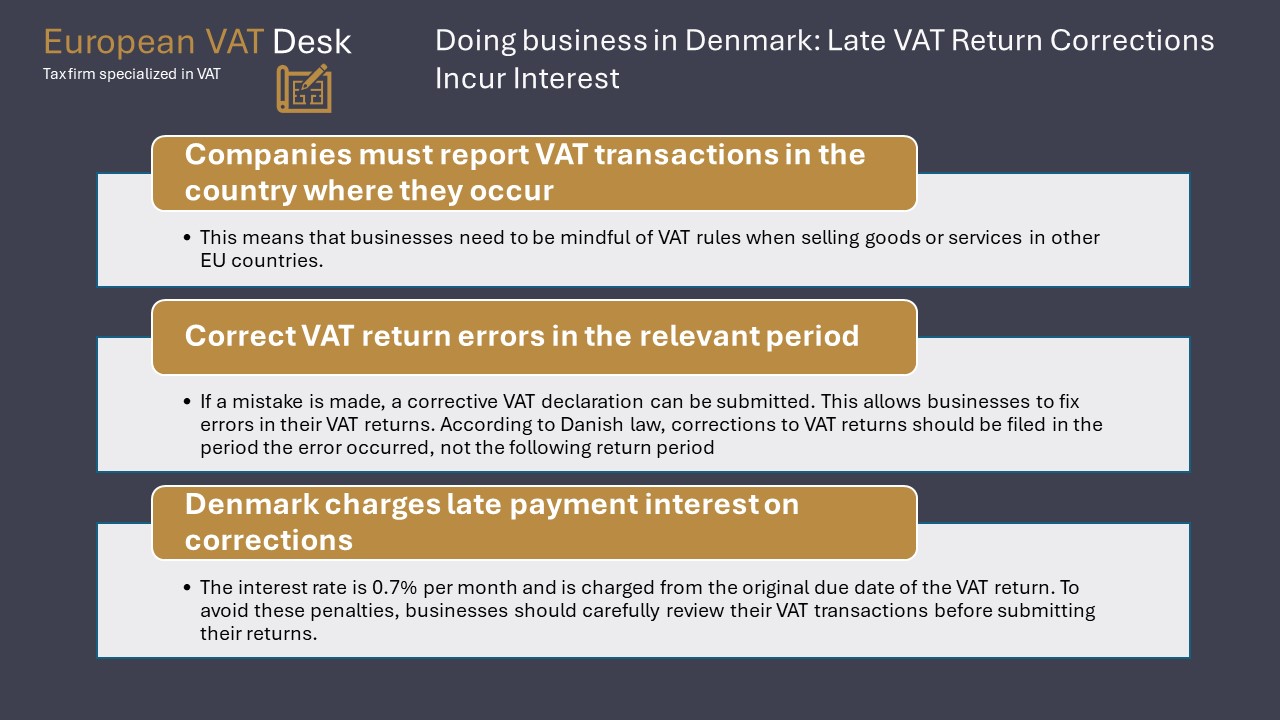

Every company which is performing transactions in another country might need to register for VAT purposes in the aforementioned country. The said transactions need to be reported in the company’s local VAT returns and errors might always occur. These possible mistakes can be corrected in some country by submitting a corrective VAT declaration. However, correcting a past VAT declaration might entail extra costs, as some countries are charging added interests.

How to make a correction in Denmark?

In Denmark, the law requires that the adjustments in a VAT return cannot be made in the following return but in the period itself where they belong.

What are the penalties?

Since July 1st, 2023, corrections in any declaration entail late payment interests if they relate to VAT due that was not declared nor paid. Those interests imposed concern the VAT corrections regardless of whether they were initiated by the Danish administration or the company itself (voluntary disclosure).

The late interests amount to 0.7% per month (8.4% per year) and are charged from the date of the original payment deadline e.g. a correction relating to a three years old transaction will bring a 28.55% surplus charge ! These interests is added automatically to your Tax Account (which gives you an overview of your business declarations and bills/charges as well as payments to and from the Danish VAT authorities).

The VAT expert's eye

It is highly advisable to review your processes in Denmark and to collect all appropriate documentation, to review potential incorrect invoices and to calculate the tax promptly, in order to avoid paying interests. Moreover it is highly important to pay attention to the timing for reporting your VAT transactions based on the chargeable event and the VAT liability and not based on the date of issue or receipt of invoices.

Don't Face Late VAT Interest Penalties in Denmark: Partner with us

Late corrections to your VAT returns incur interest charges. This can be a costly burden for businesses. Our team of VAT experts can help you navigate these changes and ensure accurate VAT compliance.

Here's how we can assist you:

- Streamlined VAT Return Preparation: We'll handle your VAT return preparation, ensuring all calculations and transactions are accurate, minimizing the risk of errors.

- Expert Review and Correction Guidance: If mistakes occur, we can help you identify and rectify them in a timely manner, minimizing potential interest charges.

- Ongoing VAT Compliance Support: We stay current on Danish VAT regulations and provide ongoing guidance to ensure your business remains compliant.

- Representation During Audits: In the event of a VAT audit, we can represent you and advocate on your behalf.

Partnering with our firm gives you the peace of mind knowing your Danish VAT returns are accurate and filed on time, saving you from costly late interest charges. Contact us today for a free consultation and discuss how we can streamline your VAT compliance.

We offer a free video conference to assess your situation and provide you with a tailored solution.